EU Tax Guidelines

The following example depicts a store based in France that sells 100k+ Euros in France and 100k+ Euros in Germany.

- Tax calculations are managed at the website level.

- Currency conversion and tax display options are controlled individually at the store view level (Select the Use Website checkbox to override the default).

- By setting the default tax country you can dynamically show the correct tax for the jurisdiction.

- Fixed product tax is included for relevant goods as a product attribute.

- It might be necessary to edit the catalog to ensure that it shows up in the correct category/website/store view.

Step 1: Create three product tax classes

For this example, it is assumed that multiple VAT-Reduced product tax classes are not needed.

-

Create a VAT-Standard product tax class.

-

Create a VAT-Reduced product tax class.

-

Create a VAT-Free product tax class.

Step 2: Create tax rates for France and Germany

Create the following tax rates:

| Tax rates | Settings |

|---|---|

| France-StandardVAT | Country: France State/Region: * ZIP/Postal Code: * Rate: 20% |

| France-ReducedVAT | Country: France State/Region: * ZIP/Postal Code: * Rate: 5% |

| Germany-StandardVAT | Country: Germany State/Region: * ZIP/Postal Code: * Rate: 19% |

| Germany-ReducedVAT | Country: Germany State/Region: * ZIP/Postal Code: * Rate: 7% |

Step 3: Set up the tax rules

Create the following tax rules:

| Tax rules | Settings |

|---|---|

| Retail-France-StandardVAT | Customer Class: Retail Customer Tax Class: VAT-Standard Tax Rate: France-StandardVAT Priority: 0 Sort Order: 0 |

| Retail-France-ReducedVAT | Customer Class: Retail Customer< Tax Class: VAT Reduced Tax Rate: France-ReducedVAT Priority: 0 Sort Order: 0 |

| Retail-Germany-StandardVAT | Customer Class: Retail Customer Tax Class: VAT-Standard Tax Rate: Germany-StandardVAT Priority: 0 Sort Order: 0 |

| Retail-Germany-ReducedVAT | Customer Class: Retail Customer Tax Class: VAT-Reduced Tax Rate: Germany-ReducedVAT Priority: 0 Sort Order: 0 |

Step 4: Set up a store view for Germany

-

On the Admin sidebar, go to Stores > Settings > All Stores.

- Under the default website, create a store view for Germany.

-

Then, do the following:

-

On the Admin sidebar, go to Stores > Settings > Configuration.

-

In the upper-left corner, set Default Config to the French store.

-

On the General page, expand

the Countries Options section, and set the default country to “France.”

the Countries Options section, and set the default country to “France.” -

Complete the locale options as needed.

-

-

In the upper-left corner, choose the German Store View.

-

On the General page, expand

Countries Options, and set the default country to “Germany.”

Countries Options, and set the default country to “Germany.” - Complete the locale options as needed.

Step 5: Configure tax settings for France

Complete the following General tax settings:

| Field | Recommended Setting |

|---|---|

| Tax Classes | |

| Tax Class for Shipping | Shipping (shipping is taxed) |

| Calculation Settings | |

| Tax Calculation Method Based On | Total |

| Tax Calculation Based On | Shipping Address |

| Catalog Prices | Including Tax |

| Shipping Prices | Including Tax |

| Apply Customer Tax | After Discount |

| Apply Discount on Prices | Including Tax |

| Apply Tax On | Custom Price (if available) |

| Default Tax Destination Calculation | |

| Default Country | France |

| Default State | |

| Default Postal Code | * (asterisk) |

| Shopping Cart Display Settings | |

| Include Tax in Grand Total | Yes |

| Fixed Product taxes | |

| Enable FPT | Yes |

| All FPT Display Settings | Including FPT and FPT description |

| Apply Discounts to FPT | No |

| Apply Tax to FPT | Yes |

| Include FPT in Subtotal | Yes |

Step 6: Configure tax settings for Germany

-

On the Admin sidebar, go to Stores > Settings > Configuration.

-

In the upper-right corner, set Store View to the view to the German store. When prompted to confirm, click OK.

-

In the left panel, expand Sales and choose Tax.

-

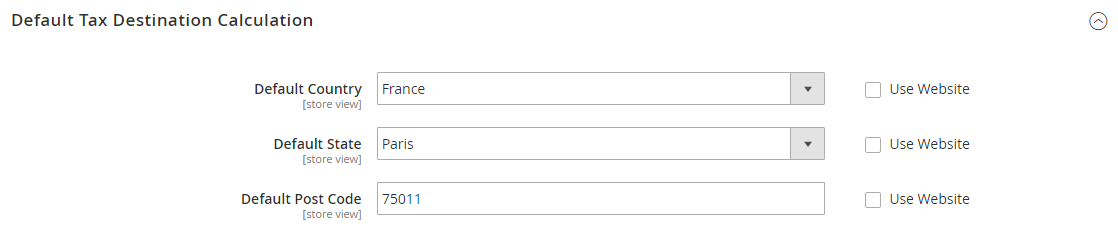

In the Default Tax Destination Calculation section, do the following:

-

Clear the Use Website checkbox after each field,

-

Update the following values to match your site’s Shipping Settings point of origin.

- Default Country

- Default State

-

Default Post Code

This setting ensures that tax is calculated correctly when product prices include tax.

Default Tax Destination Calculation

Default Tax Destination Calculation

-

-

When complete, click Save Config.