Hidden Tax Calculation

Hidden tax conditions

Hidden Tax is the amount of VAT that a discount amount has. It will be non-zero when all of these conditions are true:

- Catalog prices include tax

- The VAT rate is not zero

- There is a discount present

Thus, when there is a discount that has tax embedded in it, Magento computes a hidden tax that is added back in order to compute the discounted price.

discountedItemPrice = fullPriceWithOutTax - discountAmountOnFullPriceWithoutTax + vatAmountOnDiscountedPrice + hiddenTax

Example

- Full price of item, with tax included: $100

- VAT at: 20%

- Discount of 10% applied on item price excluding taxes:

Invalid Expected Result

- Item price after tax without discount=100 USD

- Item price before tax without discount=100/1.2=83.33 USD

- Discount=83.33*0.1=8.33 USD

- Tax=(83.33-8.33)*0.2=15 USD (invalid)

- Order Total Excluding Tax=83.33-8.33=75 USD (invalid)

- Order Total Including Tax=75+15=90 USD (invalid)

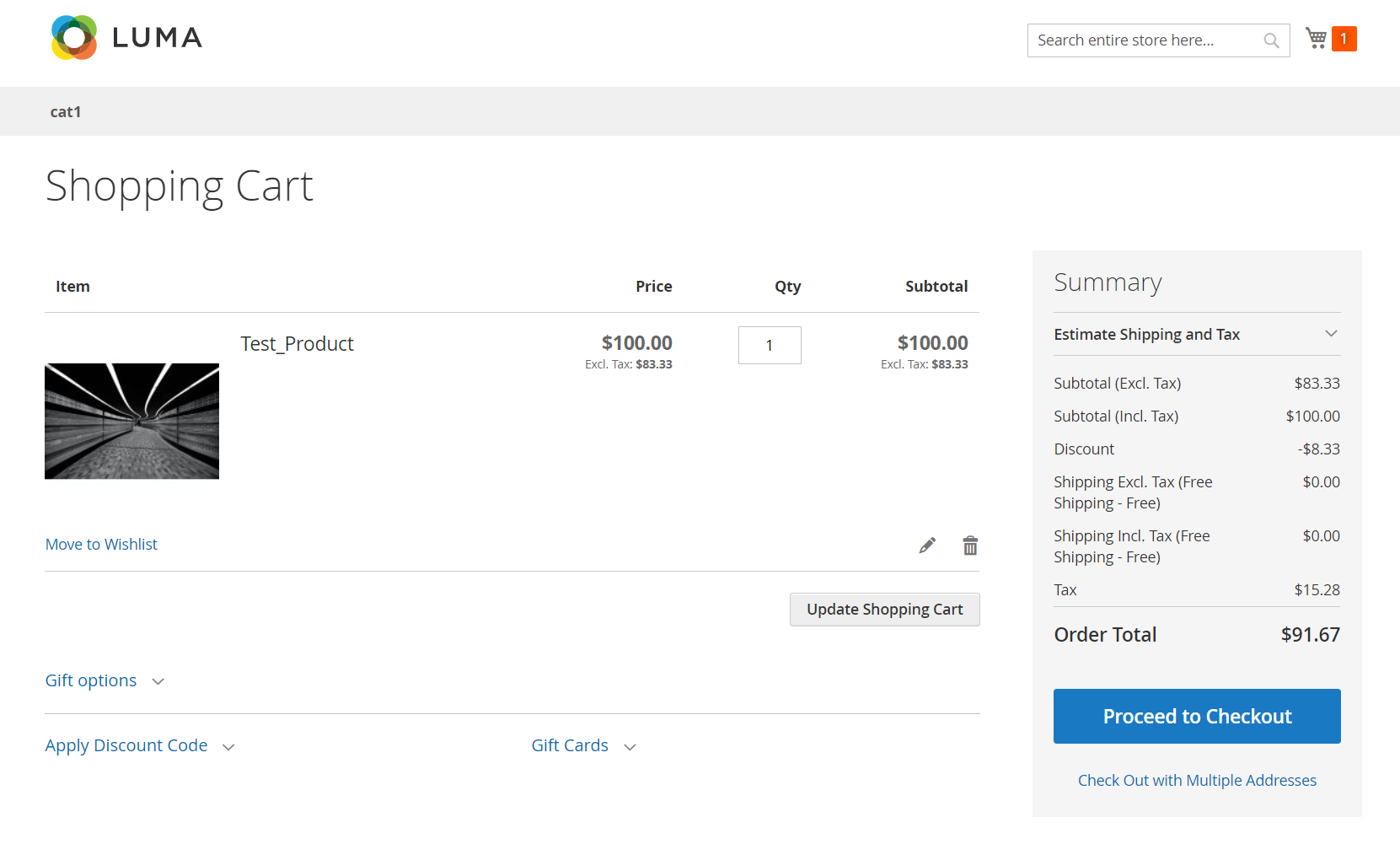

Valid Actual Result in Cart

Hidden Tax Tax Calculation in Cart

Hidden Tax Tax Calculation in Cart

Valid Calculations

-

Full price of item, without taxes is: $100 / 1.2 = $83.33

-

VAT amount on the full item price is: $100 - $83.33 = $16.67

Can also be calculated as: $100 * (1 - 1/1.2).

-

Discount of 10% on $83.33 is: $8.33 (when we don't discount tax)

-

Discounted price of item with tax is: $100 - $8.33 = $91.67

This is the customer’s perception of how discounts are applied.

-

Discounted price of item, without taxes is: $91.67 / 1.2 = $76.39

-

VAT amount on the discounted price is: $91.67 - $76.39 = $15.28 (valid)

Can also be calculated as: $91.67 * (1 - 1/1.2).

-

Hidden tax or Discount Tax Compensation is the difference between the VAT amount of the full price versus discounted price: $16.67 - $15.28 = $1.39

Another way to look at this: hidden tax is the VAT amount carried within the $8.33 discount: $8.33 * (1 - 1/1.2).

-

How the customer usually understands the discounted price (Order Total):

Full price of item including taxes less the discount amount: $100 - $8.33 = $91.67

-

How Magento calculates the discounted price (see earlier for formula):

$83.33 - $8.33 + 15.28 + 1.39 = $91.67*