After July 2021, the 2.3.x release line no longer received quality updates or user guide updates. PHP 7.3 reached end of support in December 2021, and Adobe Commerce 2.3.x reached end of support in September 2022. We strongly recommend upgrading to Adobe Commerce 2.4.x to help maintain PCI compliance.

Default Tax Destination

This site contains archived merchant documentation for a version of Adobe Commerce and Magento Open Source that has reached end-of-support.

The documentation available here is intended for historical reference only and is not maintained.

The Adobe Commerce Merchant Documentation for current releases is published on the Adobe Experience League.

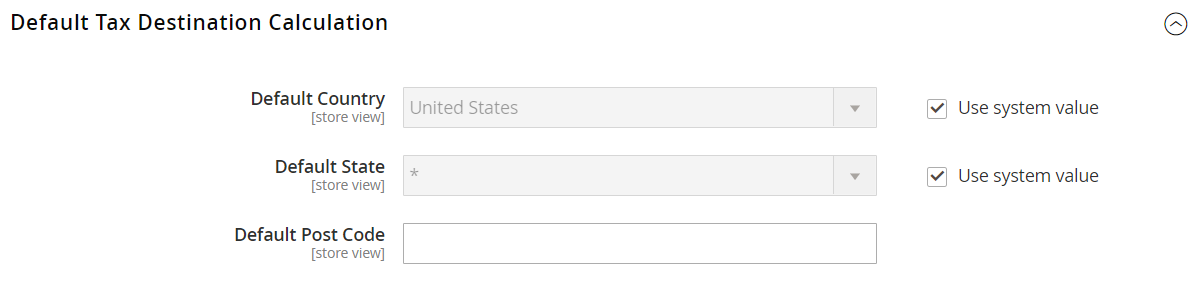

The default tax destination settings determine the country, state, and ZIP or postal code that are used as the basis of tax calculations.

Default Tax Destination Calculation

Default Tax Destination Calculation

Configure the default tax destination for calculations

-

On the Admin sidebar, go to Stores > Settings > Configuration.

-

In the left panel, expand Sales and choose Tax.

-

Expand

the Default Tax Destination Calculation section.

the Default Tax Destination Calculation section. -

Set Default Country to the country upon which tax calculations are based.

-

Set Default State to the state or province that is used as the basis of tax calculations.

-

Set Default Post Code to the ZIP or postal code that is used as the basis of local tax calculations.

-

When complete, click Save Config.